Currently Empty: 0,00 AED

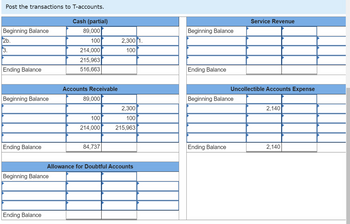

After receiving cost the company will reclassify the money on its steadiness sheet by debiting the cash account and crediting the accounts receivable account. When it comes to managing a business, guaranteeing that the corporate’s cash flow is wholesome is a top precedence. This process can be difficult, particularly for small companies, but it’s important to make sure that funds are collected on time to keep the business’s funds secure. Companies ought to often evaluate accounts receivable aging reviews and implement acceptable collection methods based on the age of outstanding balances.

By following the steps outlined above, a company can be sure that it’s correctly monitoring its outstanding invoices and receiving well timed payments. Accounts receivable is a crucial element of any enterprise that operates on a credit foundation. It is an asset that represents money owed by clients or clients to the corporate in exchange for items or services.

Shoppers often pay fees to a registered investment advisor each 4 months, billed upfront. For each business day that passes, a sure amount of charges turn into earned and non-refundable. In this case, the enterprise doesn’t record an A/R transaction however https://www.simple-accounting.org/ as a substitute enters a liability on its steadiness sheet to an account often recognized as unearned revenue or pay as you go income. To release cash circulate and improve the speed at which they will access funds, many companies provide an early-pay low cost on longer A/R balances to attempt to get their shoppers to pay them sooner.

Debit And Credit In Accounting

Following up on late customer payments can be tense and time-consuming, but tackling the issue early can save you a nice deal of bother down the road. If you do business long sufficient, you’ll ultimately come throughout purchasers who pay late, or by no means. When a client doesn’t pay and we can’t acquire their receivables, we name that a foul debt. Profit refers again to the amount of cash left after bills, money move indicates the net flow of money into and out of a business. Having adequate cash readily available additionally permits an organization to benefit from any potential enterprise alternatives that may come up.

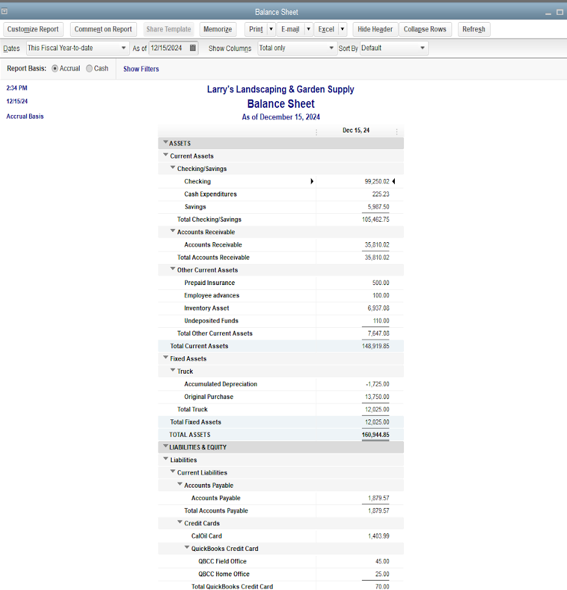

Offering clear particulars about outstanding balances demonstrates accountable monetary management practices which might enhance belief within the firm. In addition to recording the total amount owed, it’s also essential to estimate any potential unhealthy money owed that may arise. This estimation helps provide a more accurate illustration of the true value of accounts receivable. To effectively account for receivables on the steadiness sheet, corporations follow usually accepted accounting rules (GAAP). They record income when earned and create corresponding accounts receivable entries for invoiced quantities not yet received from customers. On the steadiness sheet, accounts receivable is assessed as a current asset since it’s anticipated to be converted into money within one year.

In order to hurry up these payments, some firms give credit phrases that offer a discount to those clients who pay inside a shorter period of time. The discount is known as a sales low cost, money low cost, or an early cost low cost, and the shorter time period is recognized as the low cost interval. For instance, the time period 2/10, web 30 allows a buyer to deduct 2% of the web amount owed if the shopper pays inside 10 days of the invoice date.

What’s The Difference Between Accounts Receivable And Accounts Payable?

Corporations ought to set up effective credit policies, intently monitor the growing older of accounts receivable, and diligently follow up with prospects for well timed payments. By doing so, companies can guarantee a gentle inflow of money and preserve a powerful monetary position. Firstly, a decrease in accounts receivable signifies that the company has successfully collected funds from its customers.

- It helps determine if an organization can generate adequate money from its operations to cowl its expenses and fulfill its monetary obligations.

- Save time, money, and your sanity whenever you let ReliaBills handle your invoice assortment, invoicing, reminders, and automation..

- This can impression its capability to acquire financing, and also can increase its value of borrowing.

Free Course: Understanding Monetary Statements

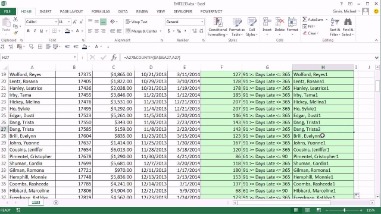

When Keith will get your bill, he’ll report it as an accounts payable in his common ledger, because it’s money he has to pay another person. Our intuitive software automates the busywork with highly effective instruments and features designed that can assist you simplify your financial administration and make knowledgeable business choices. If one customer or shopper represents more than 5% or 10% of the accounts payable, there is exposure, which could be cause for concern. For example, the accounts receivable subsidiary ledger supplies the details to support the stability in the basic ledger control account Accounts Receivable. It will comprise the date, the account name and amount to be debited, and the account name and quantity to be credited. Each journal entry must have the dollars of debits equal to the dollars of credit.

For instance, let’s assume that on the finish of its first yr of operations a company’s Dangerous Debts Expense had a debit stability of $14,000 and its Allowance for Doubtful Accounts had a credit steadiness of $14,000. As A End Result Of the revenue statement account balances are closed at the end of the yr, the company’s opening steadiness in Dangerous Debts Expense for the second 12 months of operations is $0. The credit score stability of $14,000 in Allowance for Uncertain Accounts, nonetheless, carries ahead to the second 12 months.

While it is a current asset that may improve the company’s overall web value, it could additionally lead to unhealthy debt and scale back the value of belongings if not managed effectively. By understanding the factors that impact accounts receivable, corporations can handle their property extra successfully and enhance their general financial well being. From an accountant’s perspective, Accounts Receivable is a critical element of the balance sheet and must be recorded precisely to ensure the monetary statements replicate the true place of the enterprise. From an investor’s perspective, Accounts Receivable is a vital metric to contemplate when analyzing an organization’s financial health because it provides insight into the corporate’s capacity to generate cash. Cash collected on accounts receivable performs a vital position in shaping the monetary position of a company and its general performance.